Life Insurance

What is Life Insurance?

Life insurance is nothing new – it has been around for hundreds of years. It’s basic purpose is to ensure people and their loved ones are looked financially after if something happens to them. And while the products have changed, the concept remains the same. Life insurance is designed to provide a measure of security in times of need.

What are the different types of life insurance?

Life insurance comes in many forms, with a multitude of benefits and options to suit different lifestyles and circumstances. Options range from simple mortgage protection through to sophisticated business insurance.

Today, life insurance can even provide cover should you become sick or injured and unable to work and earn a living.

Do you need life insurance?

If you have people who depend on you, a mortgage to pay, or a business to run, there’s a good chance you do need life insurance.

Answer these simple questions to find out whether life insurance is right for you.

- Are you married?

Just because you get married, it doesn’t mean you will immediately need life insurance. But if your significant other relies on you financially, you probably will. - Do you have children?

If you have children who depend on your income, then your need for life insurance increases. - Do you have a mortgage?

Similarly, having a mortgage does not necessarily mean that you need life insurance. But if something happened to you, would your family have to sell the house? - Do you own a business?

Again ask yourself, if you were to die, could the business continue? - Do other people rely on your income?

If they do, then you may have a significant need for insurance.

If you have answered YES to any of the questions above, the greater your need for life insurance. In fact, if you’ve said yes to any of the questions, then you and your family could benefit from talking to a qualified adviser, who can give you expert advice and help find the right solution for your needs.

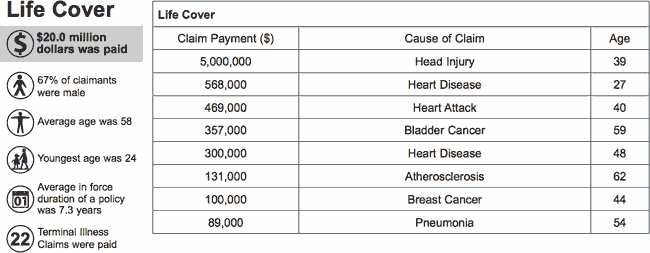

Source: American International Assurance – November 2009 to December 2010 Payouts

DISCLAIMER: These explanations and comments are general in nature only. You must refer to the appropriate policy document wordings for full and complete understanding.