Health Insurance

What is Health Insurance?

Health Insurance is designed to compliment the Public Health system.

If you have an immediately Life threatening medial situation (eg: car crash, heart attack) you are initially taken to and treated in the Public Health system. But once your situation has stabilised, any further treatment is determined by the ‘Waiting List’ for that procedure.

The length of the Waiting List is determined by the amount of money the Govt is prepared to allocate to our Hospitals.

If you have a Health Insurance policy and your condition is medically necessary (ie: not cosmetic or elective) then your Health Insurance policy will pay for your treatment in a private hospital – almost immediately.

Many people, whose conditions aren’t acute, have died waiting for treatment in the Public system; or waited in pain and agony for months or years for treatment.

With the Govt looking at ways to save money, this situation is unlikely to improve much.

Who needs Health Insurance?

- Everybody who values their health!

- Everybody who realises the cost of healthcare is enormous and that the Govt can only do so much with our tax money!

- Everybody who understands the “Waiting List” is getting longer!

- Everybody who can imagine living in pain and agony on the waiting list – now that’s scary!

Many wealthy people have been known to say “they’d give all their money away if they could have their health back.”

Optional Extras – “Specialists & Tests”

Most Health Insurance policies have a base cover that provides surgical and in-hospital treatment only. This base cover will also cover the cost of any specialists visits and tests required 6 months before and after a surgical procedure.

You can choose to add “Specialists & Tests” to your base health insurance cover so the cost of specialists and tests not resulting in a surgical procedure may be claimed.

If your health insurance policy has an ‘excess’ this is not generally offset against these claims – but some do.

Optional Extras – “Doctors, Dental, Optical”

Some Health Insurance policies have the option to add Doctors, Dental and Optical cover.

The cost of these optional extras is very high and not recommended for most people as the amount you can claim under these options is not much more than the cost of the additional premium.

It is mostly an option offered when an employer is paying for a Health Insurance package for it’s staff as an employee benefit.

Excess Options

Health Insurance has various excess options to help you control costs.

Options are generally: NIL; $250; $500; $1,000; $2,000; $4,000; $6,000.

You can change your excess option to suit your budget.

NB: Most companies don’t apply the excess to any claims under the “Specialists & Tests” option – but some do.

All Health Insurance policies have a Rate for Age premium.

A rate for age premium means the price rises each year.

As our age increases – so does the premium!

One way to reduce your premium is to increase the excess on your policy.

If you find, as you get older, the cost of your Health Insurance is becoming too high for your budget, you can increase the excess to lower the cost and keep the policy when you probably need it the most – in your “Golden Years”.

The higher the excess level you choose, the higher the discount you receive.

What does this mean?

If, for example, you have a $600 excess, you’ll need to pay the first $600 towards an accepted claim and we’ll cover the remaining costs. If you need a hip replacement and the cost of the replacement is $29,000, you’ll pay $600 and we’ll pay the remaining $28,400.

The excess applies once per life assured, per policy year. If you claim more than once in the policy year, you will need to pay your excess only once. If you make a claim in the following policy year, you’ll need to make the payment again.

Sovereign – Understanding your Health Insurance Premiums

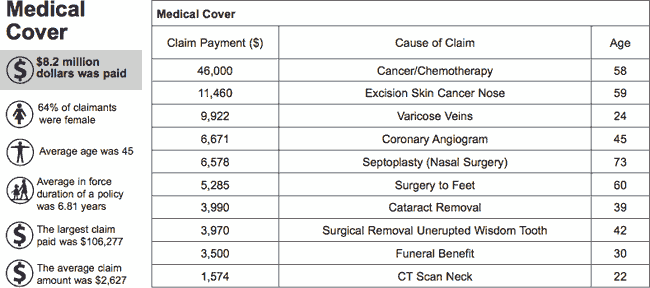

Source: American International Assurance – November 2009 to December 2010 Payouts

DISCLAIMER: These explanations and comments are general in nature only. You must refer to the appropriate policy document wordings for full and complete understanding.