Total and Permanent Disability Insurance

What is it?

Have you ever thought what would happen to you if you became permanently and totally disabled? Would you be able to meet your financial and family commitments and maintain the quality of life you and your loved ones currently enjoy?

If something tragic such as permanent and total disablement occurs to you the cost of living does not disappear and in fact would most likely increase as a result of having to pay for expensive rehabilitation treatment and other necessities that have resulted from your injury. In the event that you do become totally and permanently disabled a total and permanent disability insurance will ensure that you are paid out a lump sum of money in line with your TPD policy.

Generally speaking, Total Permanent Disability (TPD) means that because of a sickness or injury, a person is unable to work in their own or any occupation for which they are suited by training, education, or experience. An individual or group of individuals can insure themselves against it, often as part of a life insurance package, or as worker’s compensation, or separately.

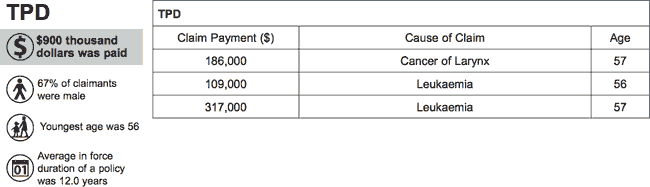

Source: American International Assurance – November 2009 to December 2010 Payouts

DISCLAIMER: These explanations and comments are general in nature only. You must refer to the appropriate policy document wordings for full and complete understanding.